Table of Content

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn't charge you fees, so you get the best mortgage deals without the hassle. Use the above calculator to see the monthly payment of a different loan amount. Loss of tax deduction—Borrowers in the U.S. can deduct mortgage interest costs from their taxes. However, only taxpayers who itemize can take advantage of this benefit.

The choice of whether to get cash out when you refinance depends on your needs. We explain the key differences to help you narrow down your choice. Connect with vetted lenders quickly through this free online marketplace.

Health Calculators

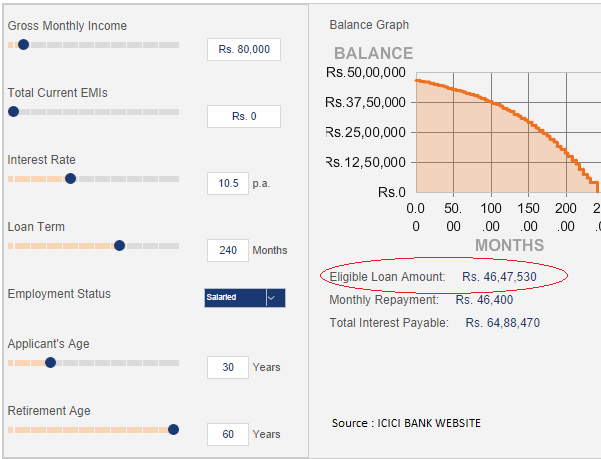

However, these limits can be higher under certain circumstances. Home loans with variable rates like adjustable-rate mortgages and home equity line of credit loans are indirectly tied to the federal funds rate. When the federal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage.

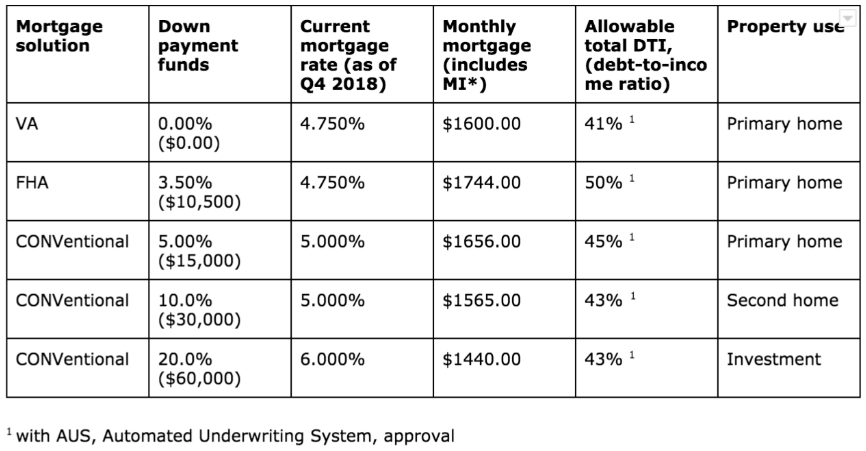

The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges. The best mortgage rate for you will depend on your financial situation. Down payment—the upfront payment of the purchase, usually a percentage of the total price. This is the portion of the purchase price covered by the borrower. Typically, mortgage lenders want the borrower to put 20% or more as a down payment. If the borrowers make a down payment of less than 20%, they will be required to pay private mortgage insurance .

Jumbo loans

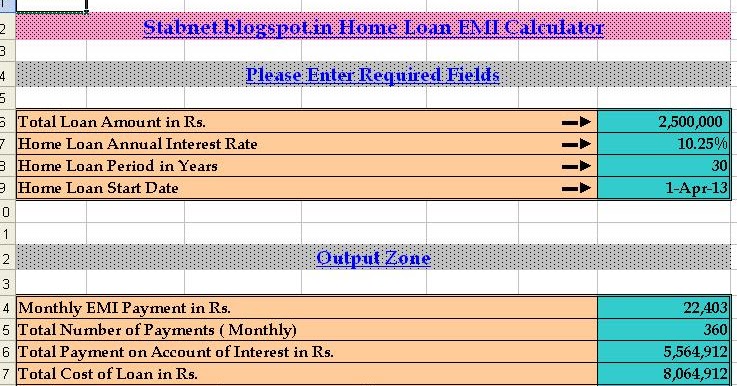

There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. Make sure to add taxes, insurance, and home maintenance to determine if you can afford the house. Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time.

During the Great Depression, one-fourth of homeowners lost their homes. We've been comparing and recommending mortgage deals for many years so you can trust you're in good hands. If you want to explore your mortgage options, it is a good idea to speak to anindependent mortgage brokerwho will be able to offer impartial advice.

How much is a mortgage point?

Assuming you have a 20% down payment ($60,000), your total mortgage on a $300,000 home would be $240,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $1,078 monthly payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary, depending its length and terms. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. Make sure to add taxes, maintenance, insurance, and other costs to the monthly payment. Penalty amounts are usually expressed as a percent of the outstanding balance at the time of prepayment or a specified number of months of interest.

Some communities, such as condominiums and townhomes, are governed by a homeowner's association that maintains communal areas and enforces rules and regulations for a monthly fee. Any HOA dues you pay each month can affect your affordability. You can edit this number in the affordability calculator advanced options.

Early repayment charge

It is not unusual for a buyer to pay about $10,000 in total closing costs on a $400,000 transaction. After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Fill out the form and click on “Calculate” to see yourestimated monthly payment.

However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. Most recurring costs persist throughout and beyond the life of a mortgage. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox.

Personal satisfaction—The feeling of emotional well-being that can come with freedom from debt obligations. A debt-free status also empowers borrowers to spend and invest in other areas. Miscellaneous—new furniture, new appliances, and moving costs are typical non-recurring costs of a home purchase. Other costs—includes utilities, home maintenance costs, and anything pertaining to the general upkeep of the property. It is common to spend 1% or more of the property value on annual maintenance alone.