Table of Content

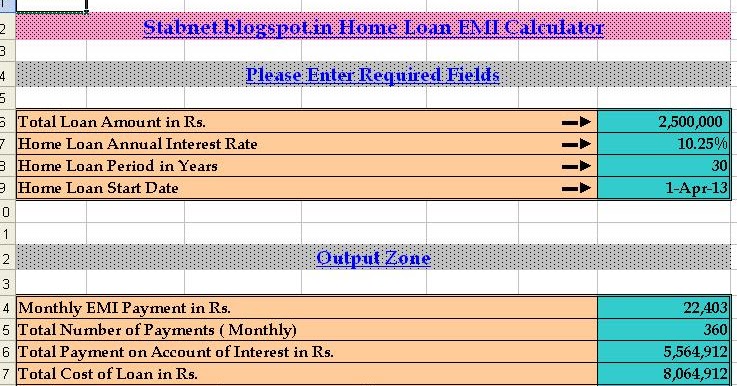

This method is mainly for those who receive their paycheck biweekly. It is easier for them to form a habit of taking a portion from each paycheck to make mortgage payments. Displayed in the calculated results are biweekly payments for comparison purposes. This calculates the monthly payment of a $300k mortgage based on the amount of the loan, interest rate, and the loan length.

The amount that a lender charges a borrower for taking out a loan. Typically, the interest rate is expressed as an annual percentage of the loan balance. The borrower makes payments to the lender over a set period of time until the loan is paid in full. Our affordability calculator uses the current national average mortgage rate.

Considerations before committing to a Mortgage

We may receive payment from our affiliates for featured placement of their products or services. We may also receive payment if you click on certain links posted on our site. It might also make sense to refinance when rates are lower than your original loan APR. This can add up to significant savings over the course of the mortgage.

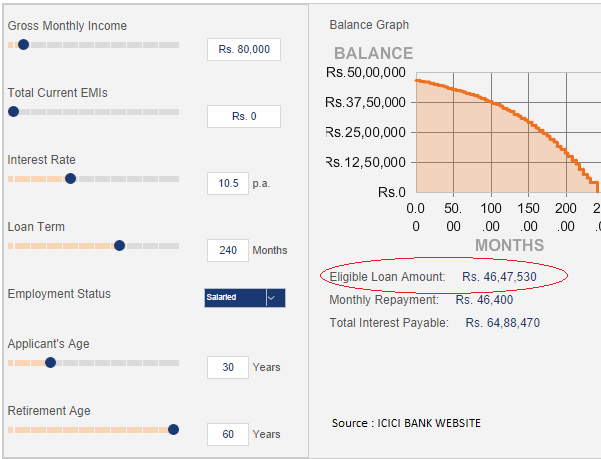

Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you're in the right range. Capital locked up in the house—Money put into the house is cash that the borrower cannot spend elsewhere. This may ultimately force a borrower to take out an additional loan if an unexpected need for cash arises.

Personal loans & lines

A shorter period, such as 15 or 20 years, typically includes a lower interest rate. The majority of high street banks offer fixed rate mortgages. These mortgages provide the opportunity to secure a set interest rate for an introductory period. The fixed rate period will normally be for 2,3,5 or 10 years. Estimate your monthly loan repayments on a $300,000 mortgage at 4% fixed interest with our amortization schedule over 15 and 30 years. At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $1,432.25 a month, while a 15-year might cost $2,219.06 a month.

If you have a co-borrower who will contribute to the mortgage, combine the total of both incomes to get your annual income. Your credit score may affect the mortgage rate that the lender offers you. Generally, the higher your credit score, the lower the interest rate will be on your home loan. Before applying for a mortgage, review your credit score and get it in the best shape possible. Making overpayments on your mortgage might be appealing because it can allow you to repay your mortgage faster. Some lenders on the high street are flexible and allow you to make as many overpayments as you like.

Physics Calculators

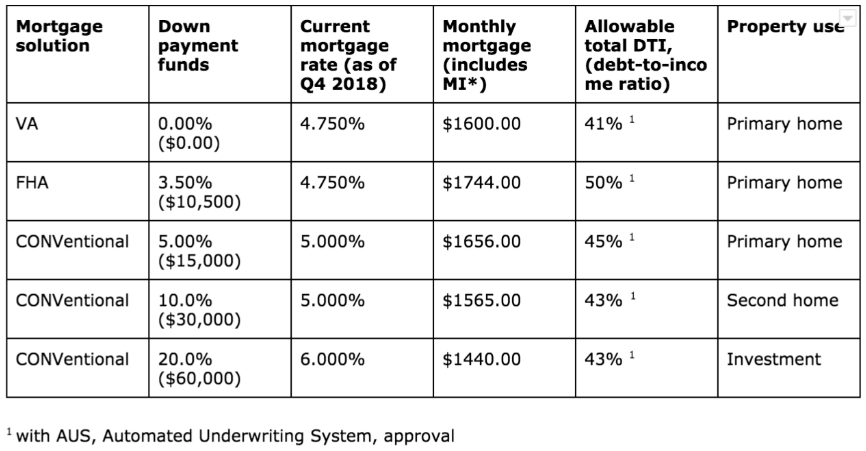

The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly. FHA loans are restricted to a maximum loan size depending on the location of the property.

When you receive lender credits in exchange for a higher interest rate, you pay less upfront but pay more over time because of the higher interest. An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. The table below is updated daily with current mortgage rates for the most common types of home loans. Compare week-over-week changes to mortgage rates and APRs.

$300,000 House — Mortgage Rates

Here's a look at home loan options that allow for down payments of 3.5% or less. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties. To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn't charge you fees, so you get the best mortgage deals without the hassle. Use the above calculator to see the monthly payment of a different loan amount. Loss of tax deduction—Borrowers in the U.S. can deduct mortgage interest costs from their taxes. However, only taxpayers who itemize can take advantage of this benefit.

Tracker mortgages’ interest rates are determined by the Bank of England’s base interest rate. Therefore, if the Bank of England raised their base interest rate, then tracker mortgages’ interest rates would follow suit. Once all the necessary information has been entered, the mortgage calculator will find all the mortgage deals available to you. New mortgage lending rules have affected the way lenders review mortgage applications. The affordability of the mortgage will now be the lenders’ priority, and to assess affordability lenders will often request the following for an application. Questions and responses on finder.com are not provided, paid for or otherwise endorsed by any bank or brand.

It is not unusual for a buyer to pay about $10,000 in total closing costs on a $400,000 transaction. After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan.

No comments:

Post a Comment